Openbravo Issue Tracking System - Retail Modules |

| View Issue Details |

|

| ID | Project | Category | View Status | Date Submitted | Last Update |

| 0056612 | Retail Modules | Web POS | public | 2024-10-01 15:51 | 2024-10-28 09:32 |

|

| Reporter | sofidossant | |

| Assigned To | kousalya_r | |

| Priority | high | Severity | major | Reproducibility | always |

| Status | closed | Resolution | invalid | |

| Platform | | OS | 5 | OS Version | |

| Product Version | pi | |

| Target Version | | Fixed in Version | | |

| Merge Request Status | |

| Review Assigned To | aferraz |

| OBNetwork customer | OBPS |

| Support ticket | 109287 |

| Regression level | |

| Regression date | |

| Regression introduced in release | |

| Regression introduced by commit | |

| Triggers an Emergency Pack | No |

|

| Summary | 0056612: Error in tax calculation |

| Description | I reproduced an order in livebuilds with 39 lines and an amount, when the 13% tax is applied, it is calculated wrong.

This is due to rounding.

Since if we take the 3 decimals the calculation is correct, but if we take 2, the calculation is wrong. |

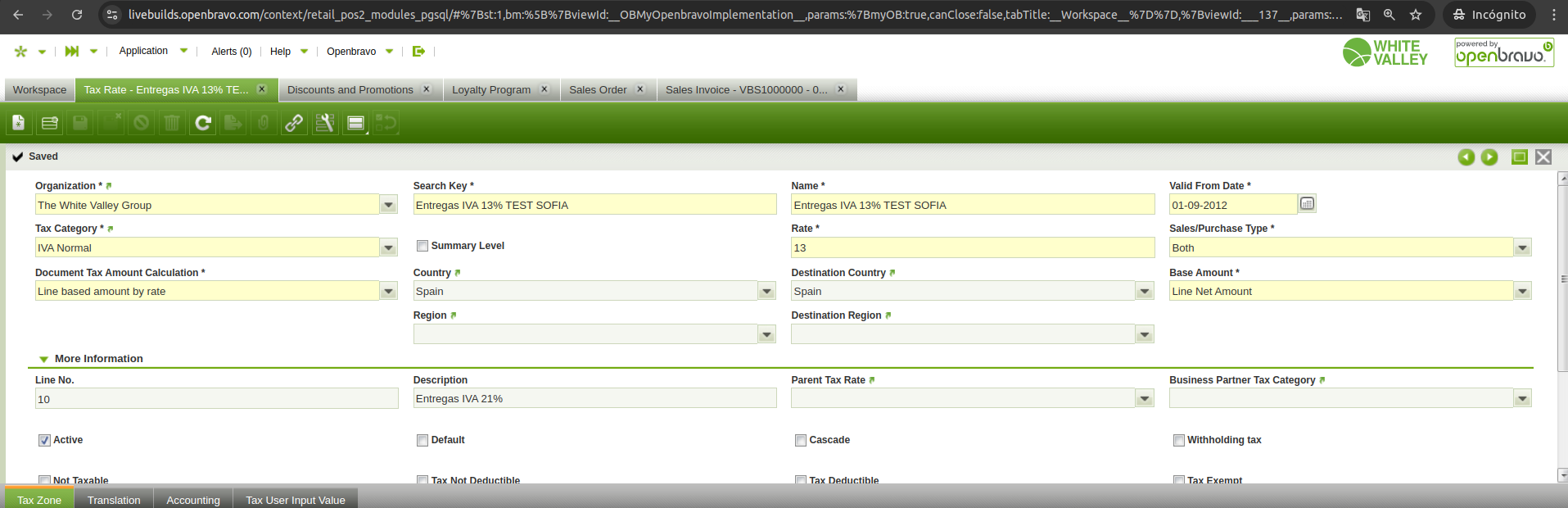

| Steps To Reproduce | 1 - Configuration of the tax rate - (attached the image)

2 - Make 39 lines of different products, and then add the quantities and amounts I attach.

IMPORTANT: if any discount is applied, deactivate them, or make the amount of the line with the discount equal to the one I attach in the excel.

Then you can see that the total of the order is 24474.24

The tax shown in the pos is 21658.56

but if I calculate the 13% of the total it is 21658.6194

There is a difference of 5

VIDEO https://drive.google.com/file/d/1ACtCLdGewuDWgBgI0ZLd2XLpZT08i7yx/view?usp=sharing [^] |

| Proposed Solution | The problem is in this line when we calculate the getTaxeLine

OB.DEC.toNumber(amount.multiply(amount).divide(amount.add(taxAmount), 20, BigDecimal.prototype.ROUND_HALF_UP));

|

| Additional Information | |

| Tags | No tags attached. |

| Relationships | | related to | defect | 0055876 | | closed | kousalya_r | Retail Modules | Tax calculation in the WebPOS distrubute the adjustment amount on different lines | | related to | defect | 0056547 | | closed | kousalya_r | Retail Modules | Tax name is incorrect when exempt tax validfrom is newer than normal tax | | related to | defect | 0056546 | | closed | kousalya_r | POS2 | Tax Exempt is not applied when tax ValidFrom is older than normal tax |

|

| Attached Files |  Captura de pantalla -2024-10-01 10-52-01.png (145,622) 2024-10-01 15:52 Captura de pantalla -2024-10-01 10-52-01.png (145,622) 2024-10-01 15:52

https://issues.openbravo.com/file_download.php?file_id=20205&type=bug

example.ods (22,520) 2024-10-01 16:18 example.ods (22,520) 2024-10-01 16:18

https://issues.openbravo.com/file_download.php?file_id=20206&type=bug |

|

| Issue History |

| Date Modified | Username | Field | Change |

| 2024-10-01 15:51 | sofidossant | New Issue | |

| 2024-10-01 15:51 | sofidossant | Assigned To | => Retail |

| 2024-10-01 15:51 | sofidossant | OBNetwork customer | => OBPS |

| 2024-10-01 15:51 | sofidossant | Support ticket | => 109287 |

| 2024-10-01 15:51 | sofidossant | Triggers an Emergency Pack | => No |

| 2024-10-01 15:52 | sofidossant | File Added: Captura de pantalla -2024-10-01 10-52-01.png | |

| 2024-10-01 15:52 | sofidossant | Steps to Reproduce Updated | bug_revision_view_page.php?rev_id=28520#r28520 |

| 2024-10-01 15:53 | sofidossant | Steps to Reproduce Updated | bug_revision_view_page.php?rev_id=28521#r28521 |

| 2024-10-01 15:54 | Practics | Issue Monitored: Practics | |

| 2024-10-01 16:18 | sofidossant | File Added: example.ods | |

| 2024-10-02 07:14 | guillermogil | Assigned To | Retail => Triage Omni OMS |

| 2024-10-02 11:01 | frank_gonzalez | Note Added: 0169894 | |

| 2024-10-02 11:01 | frank_gonzalez | Assigned To | Triage Omni OMS => kousalya_r |

| 2024-10-02 13:47 | sofidossant | Note Added: 0169900 | |

| 2024-10-08 11:16 | aferraz | Note Added: 0170090 | |

| 2024-10-08 11:16 | aferraz | Review Assigned To | => aferraz |

| 2024-10-08 11:16 | aferraz | Status | new => closed |

| 2024-10-08 11:16 | aferraz | Resolution | open => no change required |

| 2024-10-25 18:48 | sofidossant | Status | closed => new |

| 2024-10-25 18:52 | sofidossant | Note Added: 0170974 | |

| 2024-10-28 09:22 | aferraz | Relationship added | related to 0055876 |

| 2024-10-28 09:22 | aferraz | Relationship added | related to 0056547 |

| 2024-10-28 09:22 | aferraz | Relationship added | related to 0056546 |

| 2024-10-28 09:32 | aferraz | Note Added: 0171005 | |

| 2024-10-28 09:32 | aferraz | Status | new => closed |

| 2024-10-28 09:32 | aferraz | Resolution | no change required => invalid |

|

Notes |

|

|

|

|

|

|

|

|

|

|

|

The current tax information is properly calculated based on your Tax Rate configuration.

See: https://wiki.openbravo.com/wiki/Tax_Rate#Tax [^]

"Document Tax Amount Calculation" which is the way how the tax amount is going to be calculated per each tax rate (or %). The options available are:

"Document based amount by rate", this option implies that the tax amount is going to be calculated as tax amount = (tax base amounts sum at the same rate * tax rate)

"Line base amount by rate", this option implies that the tax amount is going to be calculated by line as tax amount = (tax base amount line 1 * tax rate) + (tax base amount line 2 * tax rate) + ....+ (tax base amount line n + tax rate).

As the Tax Rate is configured with Document Tax Amount Calculation = Line base amount by rate, the tax is calculated per line, that is why it doesn't match with the tax calculated by document: https://docs.google.com/spreadsheets/d/1bV9AirYmu1i_5VfhhBLsy4AADDLjdJ6qN2_VVoWW0W8 [^]

In summary:

If you configure the Tax Rate as Document Tax Amount Calculation = Line base amount by rate you will get:

Total Gross Amount: 24474.24

Total Net Amount: 21658.56

Total Tax Amount: 2815.68

If you configure the Tax Rate as Document Tax Amount Calculation = Document base amount by rate you will get:

Total Gross Amount: 24474.24

Total Net Amount: 21658.62

Total Tax Amount: 2815.62 |

|

|

|

|

|

|

|

|

|