Openbravo Issue Tracking System - Localization Pack: Spain |

| View Issue Details |

|

| ID | Project | Category | View Status | Date Submitted | Last Update |

| 0032388 | Localization Pack: Spain | Multi Dimensional Tax Report Cash VAT | public | 2016-03-02 13:24 | 2016-05-06 15:32 |

|

| Reporter | maite | |

| Assigned To | aferraz | |

| Priority | urgent | Severity | major | Reproducibility | always |

| Status | closed | Resolution | fixed | |

| Platform | | OS | 5 | OS Version | |

| Product Version | | |

| Target Version | | Fixed in Version | | |

| Merge Request Status | |

| Regression date | |

| Regression introduced by commit | |

| Regression level | |

| Review Assigned To | vmromanos |

| Support ticket | 40887 |

| OBNetwork customer | OBPS |

| Regression introduced in release | |

|

| Summary | 0032388: Wrong Settlement Date when invoice date is in 2014 (so manual settlement is in 2015) and payment date in 2016 |

| Description | Wrong Settlement Date when invoice date is in 2014 (so manual settlement is in 2015) and payment date in 2016 |

| Steps To Reproduce | 1. Register Sales Invoice set as "Cash vat" and with date in 2014. Add any line. Process and post invoice

2. According with the law, vat settlement for this invoice should be done at the end of 2015 (http://wiki.openbravo.com/wiki/Cash_VAT_Management/User_Documentation_Spanish#Liquidaci.C3.B3n_manual_del_IVA_de_Caja [^])

3. Register Payment In for this invoice with payment date in 2016. Process payment

4. Run Multidimensional Tax Report Cash VAT for 2016 year and realize that invoice appears with Settlement Date in 2016 when should be in 2015 |

| Proposed Solution | |

| Additional Information | |

| Tags | No tags attached. |

| Relationships | |

| Attached Files |  Issue_32388.png (119,784) 2016-03-02 15:40 Issue_32388.png (119,784) 2016-03-02 15:40

https://issues.openbravo.com/file_download.php?file_id=9125&type=bug

|

|

| Issue History |

| Date Modified | Username | Field | Change |

| 2016-03-02 13:24 | maite | New Issue | |

| 2016-03-02 13:24 | maite | Support ticket | => 40887 |

| 2016-03-02 13:24 | maite | OBNetwork customer | => Yes |

| 2016-03-02 13:25 | maite | Resolution time | => 1459634400 |

| 2016-03-02 13:25 | maite | Issue Monitored: networkb | |

| 2016-03-02 15:21 | psanjuan | Note Added: 0084659 | |

| 2016-03-02 15:24 | psanjuan | Note Edited: 0084659 | bug_revision_view_page.php?bugnote_id=0084659#r11311 |

| 2016-03-02 15:35 | psanjuan | Note Edited: 0084659 | bug_revision_view_page.php?bugnote_id=0084659#r11312 |

| 2016-03-02 15:39 | psanjuan | Note Edited: 0084659 | bug_revision_view_page.php?bugnote_id=0084659#r11313 |

| 2016-03-02 15:40 | psanjuan | Note Edited: 0084659 | bug_revision_view_page.php?bugnote_id=0084659#r11314 |

| 2016-03-02 15:40 | psanjuan | File Added: Issue_32388.png | |

| 2016-03-02 15:42 | psanjuan | Note Edited: 0084659 | bug_revision_view_page.php?bugnote_id=0084659#r11315 |

| 2016-03-03 11:26 | psanjuan | Note Edited: 0084659 | bug_revision_view_page.php?bugnote_id=0084659#r11337 |

| 2016-03-03 11:26 | psanjuan | Note Edited: 0084659 | bug_revision_view_page.php?bugnote_id=0084659#r11338 |

| 2016-03-03 11:46 | psanjuan | Note Edited: 0084659 | bug_revision_view_page.php?bugnote_id=0084659#r11339 |

| 2016-04-21 18:35 | dmitry_mezentsev | Assigned To | => Triage Finance |

| 2016-04-21 18:57 | aferraz | Assigned To | Triage Finance => AtulOpenbravo |

| 2016-04-25 07:58 | AtulOpenbravo | Status | new => scheduled |

| 2016-04-25 14:48 | aferraz | Assigned To | AtulOpenbravo => aferraz |

| 2016-05-06 13:43 | psanjuan | Note Added: 0086270 | |

| 2016-05-06 13:53 | psanjuan | Note Edited: 0086270 | bug_revision_view_page.php?bugnote_id=0086270#r12001 |

| 2016-05-06 14:15 | psanjuan | Note Edited: 0086270 | bug_revision_view_page.php?bugnote_id=0086270#r12002 |

| 2016-05-06 14:22 | psanjuan | Note Edited: 0086270 | bug_revision_view_page.php?bugnote_id=0086270#r12003 |

| 2016-05-06 14:34 | psanjuan | Note Edited: 0086270 | bug_revision_view_page.php?bugnote_id=0086270#r12004 |

| 2016-05-06 14:40 | psanjuan | Note Edited: 0086270 | bug_revision_view_page.php?bugnote_id=0086270#r12005 |

| 2016-05-06 14:49 | psanjuan | Note Edited: 0086270 | bug_revision_view_page.php?bugnote_id=0086270#r12006 |

| 2016-05-06 14:50 | psanjuan | Note Edited: 0086270 | bug_revision_view_page.php?bugnote_id=0086270#r12007 |

| 2016-05-06 14:54 | psanjuan | Note Edited: 0086270 | bug_revision_view_page.php?bugnote_id=0086270#r12008 |

| 2016-05-06 14:59 | psanjuan | Note Edited: 0086270 | bug_revision_view_page.php?bugnote_id=0086270#r12013 |

| 2016-05-06 15:15 | psanjuan | Note Added: 0086271 | |

| 2016-05-06 15:26 | hgbot | Checkin | |

| 2016-05-06 15:26 | hgbot | Note Added: 0086272 | |

| 2016-05-06 15:26 | hgbot | Status | scheduled => resolved |

| 2016-05-06 15:26 | hgbot | Resolution | open => fixed |

| 2016-05-06 15:26 | hgbot | Fixed in SCM revision | => http://code.openbravo.com/erp/pmods/org.openbravo.module.invoiceTaxReportEnhanced30.cashvat/rev/c332bbd2aa880459577ec58814d763a8e1e413ee [^] |

| 2016-05-06 15:26 | hgbot | Checkin | |

| 2016-05-06 15:26 | hgbot | Note Added: 0086273 | |

| 2016-05-06 15:32 | aferraz | Review Assigned To | => vmromanos |

| 2016-05-06 15:32 | aferraz | Note Added: 0086274 | |

| 2016-05-06 15:32 | aferraz | Status | resolved => closed |

|

Notes |

|

|

(0084659)

|

|

psanjuan

|

2016-03-02 15:21

(edited on: 2016-03-03 11:46) |

|

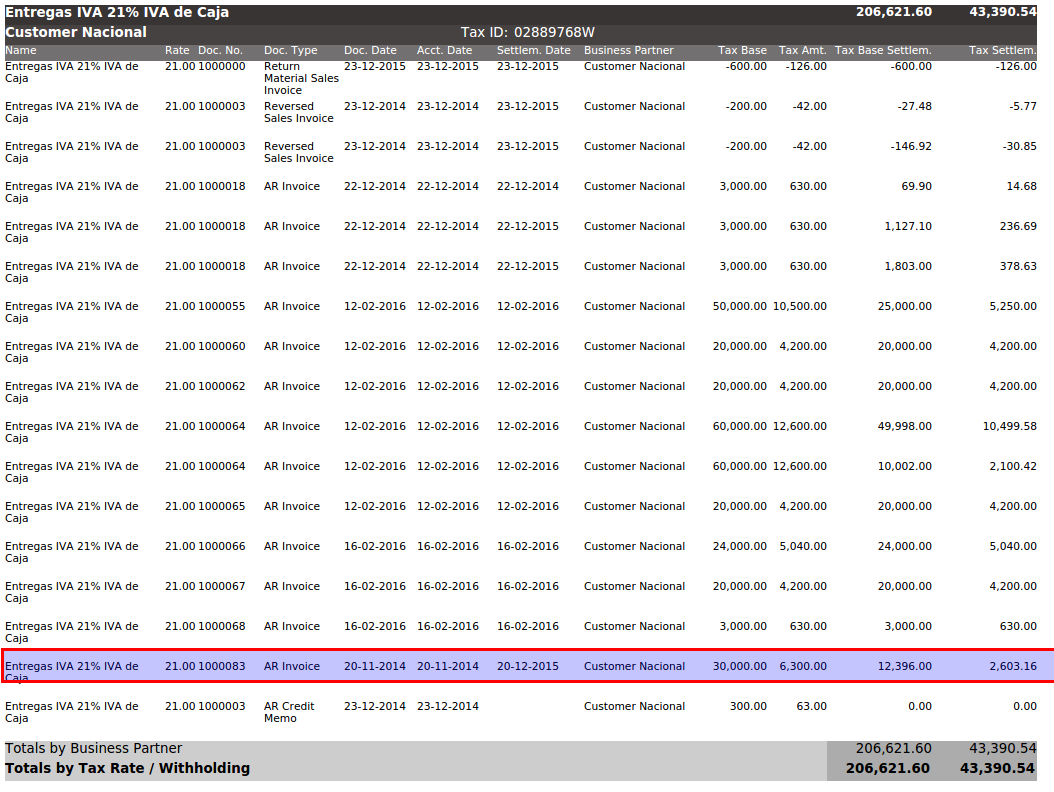

Scenario 1

Issue a sales invoice set as "Cash VAT" for any BP located in Spain, with below setup:

- Invoice Date = Accounting Date = 20-11-2014

Add any line by making sure that the tax used is for instance: "Entregas IVA 21% IVA de Caja".

Complete and post the invoice.

Add a payment in of half of the invoice amount dated on 20-12-2015 for instace.

Navigate to Tax tab, Cash VAT tab and make sure below data is shown:

Payment Date = 20-12-2015

Percentage = 41.32

Taxable Amount = 12.396

Tax Amount = 2.603.16

Payment = 1000068 - 20-12-2015 - 15000.00€

Go to "Manual Cash Vat Settlement" window and create a new record for the org by entering below data:

Starting Date = 01-01-2014

Ending Date = 31-12-2014

Accounting Date = 31-12-2015

Click on "Pick Lines&Complete".

Check that the sales invoice created is shown in there, showing a 58.68% (remaining %). Select the invoice and click on Complete.

Post it.

Go back to the sales invoice and check there is a new line in Cash VAT setup with below data:

Payment Date = (empty)

Percentage = 58.68

Taxable Amount =17604.00

Tax Amount = 3696.84

Payment = (empty)

Manual Settlement = Yes

Manual Cash VAT Settlement line = 1000333..etc

Manual Cash VAT Settlement Date = 31-12-2015

Add a new payment to the invoice for the rest of the amount dated on 02-03-2016.

Take note of the invoice, in our case it is sales invoice 1000083.

Run Multidimensional Tax Report Cash VAT with below data:

Show details info selected

From Date = 01-01-2014

To Date = 30-03-2016

Organization = select the Organization

Business Partner = select the BP used.

Tax selected

Sales/Receipt transactions selected

Press HTML format.

Search the section related to the tax "Entregas IVA 21% IVA de Caja".

Check that only one line is shown there for invoice 1000083, the one related to the payment in dated on 20-12-2015. See image attached (Issue_32388)

Proposed Solution:

There should be another line with the VAT settled dated on 30-12-2015, with below information:

Name = Entregas IVA 21% IVA de Caja

Rate = 21%

Doc No = 1000083

Doc type = AR Invoice

Doc Date = 20-11-2014

Acc date = 20-11-2014

Settl date = 31-12-2015

Business Partner = Customer Nacional

Tax Base = 30000.00

Tax Amount = 6300.00

Tax Base Sett = 17604.00

Tax Settlem. = 3696.84

Scenario 2

Issue a sales invoice set as "Cash VAT" for any BP located in Spain, with below setup:

- Invoice Date = Accounting Date = 03-03-2014

Add any line by making sure that the tax used is for instance: "Entregas IVA 21% IVA de Caja".

Complete and post the invoice. (i.e Invoice number 1000085)

Go to "Manual Cash Vat Settlement" window and create a new record for the org by entering below data:

Starting Date = 01-01-2014

Ending Date = 31-12-2014

Accounting Date = 31-12-2015

Click on "Pick Lines&Complete".

Check that the sales invoice created is shown in there, showing a 100% pending to be settled. Select the invoice and click on Complete.

Post it.

Go back to the sales invoice and check there is a new line in Cash VAT setup with below data:

Payment Date = (empty)

Percentage = 100

Taxable Amount =11000.00

Tax Amount = 2310.00

Payment = (empty)

Manual Settlement = Yes

Manual Cash VAT Settlement line = 100034..etc

Manual Cash VAT Settlement Date = 31-12-2015

Add a payment to the invoice dated on 03-03-2016.

Run Multidimensional Tax Report Cash VAT with below data:

Show details info selected

From Date = 01-01-2014

To Date = 30-03-2016

Organization = select the Organization

Business Partner = select the BP used.

Tax selected

Sales/Receipt transactions selected

Press HTML format.

Search the section related to the tax "Entregas IVA 21% IVA de Caja".

Check that there is one line shown in there for invoice 1000085 with no info about the VAT Settled dated on 31-12-2015

Proposed Solution:

There should be a line with the VAT settled dated on 30-12-2015, with below information:

Name = Entregas IVA 21% IVA de Caja

Rate = 21%

Doc No = 1000085

Doc type = AR Invoice

Doc Date = 03-03-2014

Acc date = 03-03-2014

Settl date = 31-12-2015

Business Partner = Customer Nacional

Tax Base = 11000.00

Tax Amount = 2310.00

Tax Base Sett = 11000.00

Tax Settlem. = 2310.00

|

|

|

|

(0086270)

|

|

psanjuan

|

2016-05-06 13:43

(edited on: 2016-05-06 14:59) |

|

Test Plan above verified

Additional Test Plan:

Invoice dated on 2014 - do not paid in 2014 - report launched for 2014 = Invoice is shown in the report do not settled.

Invoice dated on 2014 - totally paid in 2014 - report launched for 2014 = Invoice is shown in the report 100% settled dated on 2014 payment date.

Invoice dated on 2014 - totally paid in 2015 - report launched for 2015 = Invoice is shown in the report 100% settled dated on 2015 payment date

Invoice dated on 2014 - do not paid in 2014 + manual settlement in 2015 - report launched for 2015 = Invoice is shown in the report 100% settled dated on Manual Settlement date 30-12-2015

Invoice dated on 2014 - do not paid in 2014 + manual settlement in 2015 (30-12-2015) + payment in 2015 (31-12-2015) - report launched for 2015 = Invoice is shown in the report only once 100% settled dated on Manual Settlement date 30-12-2015

Invoice dated on 2014 - do not paid in 2014 + manual settlement in 2015 + payment in 2016 - report launched for 2015 = Invoice is shown in the report only once 100% settled dated on Manual Settlement date 31-12-2015

Invoice dated on 2014 - do not paid in 2014 + manual settlement in 2015 + payment in 2016 - report launched for 2016 = Invoice is not shown.

Invoice dated on 2014 - partially paid in 2015 + manual settlement in 2015 - report launched for 2015 = Invoice is shown twice, one line showing as settlement date 2015 payment date (30-05-2015) and the tax base and tax settled and the other one showing manual settlement date (31-12-2015) and the tax base and tax settled.

Sales order dated on 2014 prepaid on 2014 (invoice created from the order dated on 2014) + invoice partially paid in 2015 + Manual Cash VAT Settlement in 2015 - launch report for 2015 - Invoice is shown twice one for the 2015 payment and second one for the manual settlement.

Repeat same test as above for corrective invoices.

Repeat same test as above for purchase orders/invoices.

|

|

|

|

|

Test plan above verified.

Issue can be code reviewed and closed. |

|

|

|

(0086272)

|

|

hgbot

|

|

2016-05-06 15:26

|

|

Repository: erp/pmods/org.openbravo.module.invoiceTaxReportEnhanced30.cashvat

Changeset: c332bbd2aa880459577ec58814d763a8e1e413ee

Author: Alvaro Ferraz <alvaro.ferraz <at> openbravo.com>

Date: Thu May 05 19:39:20 2016 +0200

URL: http://code.openbravo.com/erp/pmods/org.openbravo.module.invoiceTaxReportEnhanced30.cashvat/rev/c332bbd2aa880459577ec58814d763a8e1e413ee [^]

Fixes issue 32388:Wrong settlement date in Multidimensional Tax Report Cash VAT

Include settlement date in invoices settled by Manual Cash VAT Settlement in getInvoicePayments method and exclude invoices settled by Manual Cash VAT Settlement in getInvoicesWithoutPayments method.

---

M src/org/openbravo/module/invoiceTaxReportEnhanced30/cashvat/ad_reports/OBMTRCVInvoiceTaxReportDao.java

A src-db/database/model/functions/OBMTRCV_GETMANUALSETTLDATE.xml

A src/org/openbravo/module/invoiceTaxReportEnhanced30/cashvat/databaseProcess/OBMTRCVGetSettlementDate.java

---

|

|

|

|

(0086273)

|

|

hgbot

|

|

2016-05-06 15:26

|

|

|

|

|

|

|

Code review OK done by vmromanos |

|