Openbravo Issue Tracking System - Openbravo ERP |

| View Issue Details |

|

| ID | Project | Category | View Status | Date Submitted | Last Update |

| 0012152 | Openbravo ERP | 09. Financial management | public | 2010-02-05 10:15 | 2010-03-10 18:29 |

|

| Reporter | networkb | |

| Assigned To | dalsasua | |

| Priority | high | Severity | minor | Reproducibility | always |

| Status | closed | Resolution | no change required | |

| Platform | | OS | 5 | OS Version | |

| Product Version | 2.50MP11 | |

| Target Version | | Fixed in Version | | |

| Merge Request Status | |

| Review Assigned To | |

| OBNetwork customer | OBPS |

| Web browser | |

| Modules | Core |

| Support ticket | |

| Regression level | |

| Regression date | |

| Regression introduced in release | |

| Regression introduced by commit | |

| Triggers an Emergency Pack | No |

|

| Summary | 0012152: Uncorrect asset amortization when "Monthly" is used |

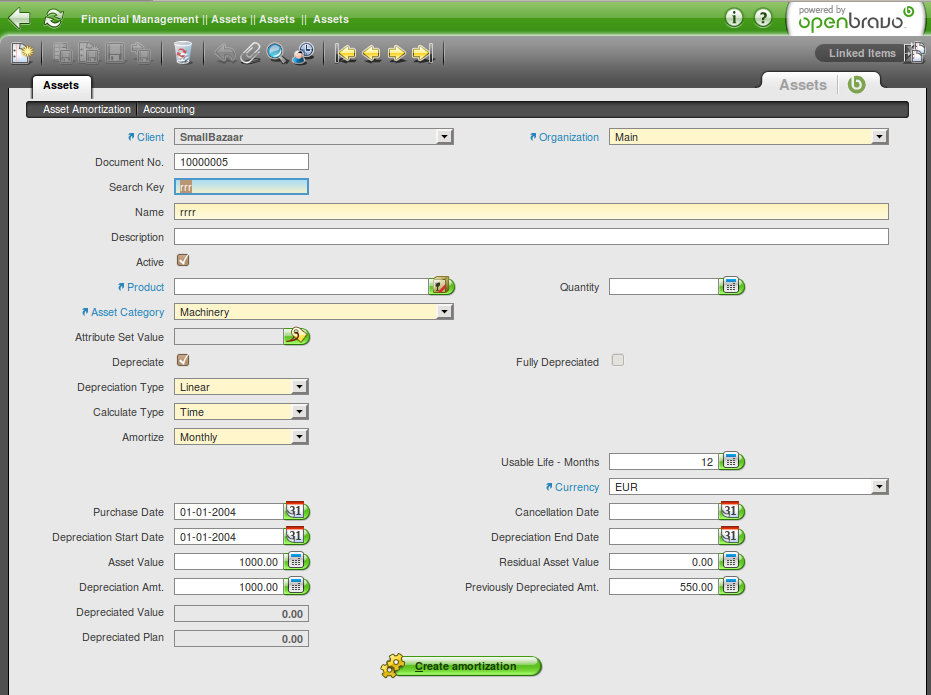

| Description | An asset amortization is calculated, for an asset. "Time" and "Monthly", calculation type is used.

IE, if 12 Uselife months are set, 13 lines are created. |

| Steps To Reproduce | Go to Financial Management || Assets || Assets. Create a new register.

Enter a name, search key.

Check Depreciate.

Select "Linear" as Depreciation type.

Select "Time" as Calculate type.

Select "Monthly" as Amortize.

Enter, "12" as Usable Life - Months.

Enter "20-01-2004", as Purchase Date and Depreciation Start Date.

Enter, "1000" as Asset Value and Depreciation Amt.

Enter, "550" as Previously Depreciated Amt.

Press "Calculate amortization".

Go to Asset amortization tab. |

| Proposed Solution | |

| Additional Information | |

| Tags | No tags attached. |

| Relationships | | related to | defect | 0012184 | | closed | adrianromero | Line No not auto-incremented when Create Amortization. |

|

| Attached Files |  AmortHeader.png (78,958) 2010-02-08 09:48 AmortHeader.png (78,958) 2010-02-08 09:48

https://issues.openbravo.com/file_download.php?file_id=2180&type=bug

Amort.png (69,835) 2010-02-08 09:48 Amort.png (69,835) 2010-02-08 09:48

https://issues.openbravo.com/file_download.php?file_id=2181&type=bug

NewAmort.png (72,865) 2010-02-08 10:55 NewAmort.png (72,865) 2010-02-08 10:55

https://issues.openbravo.com/file_download.php?file_id=2182&type=bug

|

|

| Issue History |

| Date Modified | Username | Field | Change |

| 2010-02-05 10:15 | networkb | New Issue | |

| 2010-02-05 10:15 | networkb | Assigned To | => rafaroda |

| 2010-02-05 10:15 | networkb | OBNetwork customer | => Yes |

| 2010-02-08 09:46 | rafaroda | Note Added: 0023998 | |

| 2010-02-08 09:46 | rafaroda | Status | new => feedback |

| 2010-02-08 09:48 | rafaroda | File Added: AmortHeader.png | |

| 2010-02-08 09:48 | rafaroda | File Added: Amort.png | |

| 2010-02-08 10:45 | networkb | Target Version | 2.50MP13 => |

| 2010-02-08 10:45 | networkb | Steps to Reproduce Updated | bug_revision_view_page.php?rev_id=4#r4 |

| 2010-02-08 10:45 | networkb | Status | feedback => new |

| 2010-02-08 10:45 | networkb | Note Added: 0024001 | |

| 2010-02-08 10:54 | rafaroda | Note Added: 0024003 | |

| 2010-02-08 10:54 | rafaroda | Status | new => acknowledged |

| 2010-02-08 10:55 | rafaroda | File Added: NewAmort.png | |

| 2010-02-08 12:54 | dalsasua | Note Added: 0024012 | |

| 2010-02-09 11:02 | rafaroda | Assigned To | rafaroda => dalsasua |

| 2010-02-09 11:02 | rafaroda | Status | acknowledged => scheduled |

| 2010-02-09 11:03 | rafaroda | Note Added: 0024045 | |

| 2010-02-09 11:03 | rafaroda | Status | scheduled => closed |

| 2010-02-09 11:03 | rafaroda | Resolution | open => no change required |

| 2010-02-09 11:05 | rafaroda | Relationship added | related to 0012184 |

| 2010-02-10 12:43 | anonymous | sf_bug_id | 0 => |

| 2010-03-10 18:29 | anonymous | sf_bug_id | => 2968017 |

|

Notes |

|

|

|

|

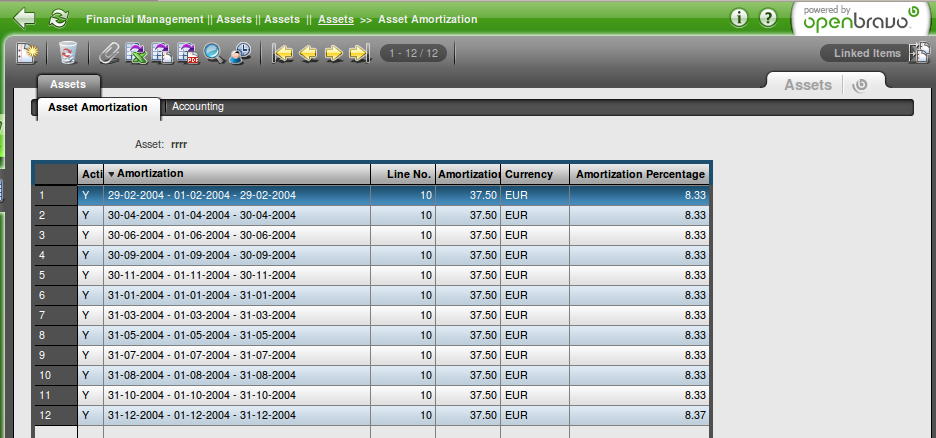

Please provide more information since the issue has not been able to be reproduced (see 2 screenshots attached). |

|

|

|

|

|

|

|

|

|

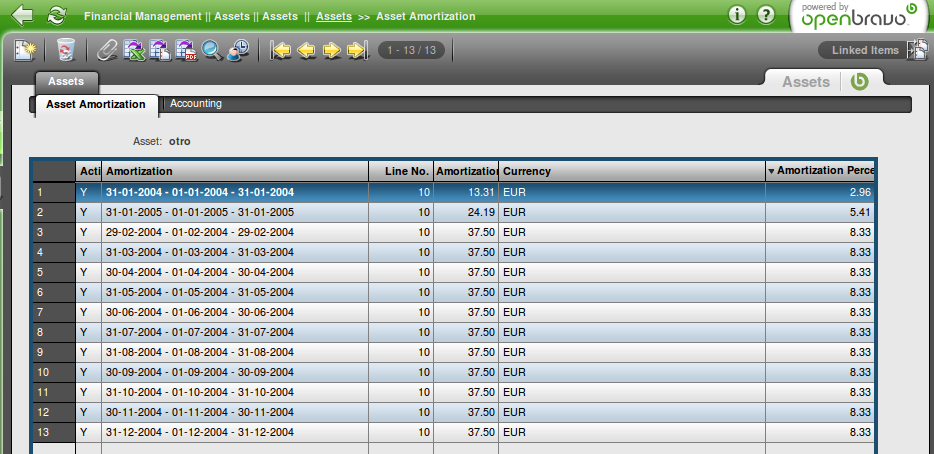

Can be reproduced with the new steps provided (see image NewAmort.png) |

|

|

|

|

Have you used as purchase and depr.start dates 20-01-2004 (as in steps to reproduce), or 01-01-2004 (as in the screenshots)?

If I set date=01-01-2004 I obtain 12 rows of 37.5 = 450 € (what is correct: 1000-550)

If I set date=20-01-2004 I obtaain 13 rows: 11*37.50+1*24.19+1*13.31 = 450 € (what is correct)

Please notice that, although the number of rows is 13, the number of months where this asset is being depreciated is 12:

row01_20-01-2004_31-01-2004_12 days

row02_01-02-2004_29-02-2004_1 month

row03_01-03-2004_31-03-2004_1 month

...

row12_01-12-2004_31-12-2004_1 month

row13_01-01-2005_19-01-2005_19 days

TOTAL: 12 days + 11 months + 19 days = 12 months.

Please notice that depreciations do always take place at the end of the period. In this case, last day of the month.

Regards. |

|

|

|

|

|

The behaviour described, creating 13 records (but 12 months) if the initial date is 20-01-2004 is correct so no change is required. |

|